On November 15, 2020, the New Zealand Herald ran an article titled, ‘What negative interest rates would mean for borrowers and savers’. It said that the Central Bank was seriously considering negative interest rates as an option to stimulate the economy in the post COVID recovery.

A mere 18 months later, the Central Bank raised the OCR to 2.5%, and indicted further upward moves were likely as outlined in its May Monetary Policy Statement.

The Reserve Bank Governor’s comment at the time was succinct and accurate, “We’re in a different world now.” Not unsurprisingly, financial markets had priced lower interest rates into bond prices in 2019 and 2020 and investors got higher than normal returns as a result. In both 2019 and 2020, bonds provided investors very attractive returns. The Global Sustainability Bond Trust

by Dimensional earned investors 8.64% in 2019 and 7.66% in 2020.

Since those heady days, market expectations about interest rates have changed dramatically. Markets no longer consider negative rates a possibility. Now markets are focused on inflation. Supply shortages, logistics problems and workforce constraints, combined with international energy disruptions, have pushed prices higher across many goods and services. Bond markets have absorbed this information and investors are now seeking a higher return on bonds. In response, bond prices have gone down and many investors received negative returns.

It’s important to point out that the poor recent bond returns are not the result of fund management or the credit worthiness of the underlying bonds themselves.

Poor returns are due to investors expecting inflation and requiring a higher yield as a result.

While that explains what happened, the question remains; should you still own bonds in your portfolio?

The answer in general is yes, although we always need to consider individual circumstances. It is worthwhile to provide some context and evidence for our position, especially considering recent returns.

1. Bonds are still a good diversifier

Historically, bonds have been an excellent diversifier to shares. Since 1993 (as far back as we have NZ data at our disposal), there has been only one other calendar year where bond prices and share prices were both negative; in 1994 which we have circled below. By contrast we can look at 1998, 2000 and 2008 and see where bond prices went up while share prices that went down providing that diversification benefit investors are looking for.

2. Bonds help control volatility

Another illustration of the below chart is the narrower range of returns. While returns from shares can range from +50% to -40%, returns from bonds have never exceeded 20% in either direction.

An appropriate allocation to bonds will reduce the volatility risk for your portfolio, which is especially important if you have a shorter investment time horizon.

3. Bonds are still credit worthy

The bond funds used in our portfolios are overwhelmingly comprised of bonds selected from borrowers that are investment grade rated (BBB, A, AA, and AAA). Those borrowers, which include the NewZealand Government, are very likely to pay back the bonds. If investors hold on for the long run, they will likely receive the positive return that comes from those borrowers making their scheduled payments.

4. Increasing rates are priced in

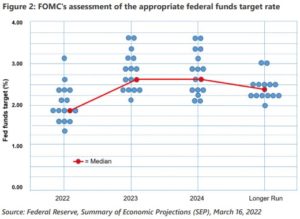

But what if interest rates go up more from here? Won’t that lead to lower bond returns? Not necessarily. The expectation is that interest rates will go up, and those expected increases are already priced in by the market. The reason they are priced in is because there is substantial, publicly available information about the intentions of central banks with future interest rate movements. One source is the projections made by US Federal Open Market Committee Members. Those projections are in the chart summarised below. Each dot represents the opinion of a member on where interest rates will be for the years 2022 – 2024 and then longer term.

This chart shows that some members, called ‘doves’, believe interest rates will be lower than the median projection, while others, called ‘hawks’ believe they will be higher than the median projection. The median position is plotted in a line in the chart above. The question for bond prices will not be whether rates go up, but rather how much they go up by and whether the hawks or the doves are closer to the truth. This is a question that markets adjust for everyday making the answer a 50/50 guess. After all, prices must fairly include all known expectations for both a buyer and seller to willingly trade.

5. The yield to maturity and thus the expected return, is much higher now

On a positive note, bonds are yielding more than in previous years. The Dimensional Global Bond Sustainability Trust, as of the date of writing, is yielding 4.77% . That number was closer to 1.0% 18 months ago.

What that means for investors is that bonds now have a much higher expected return. Even if prices go down, investors could still earn a positive return because they are starting from a 4.77% yield rather that 1.0% yield.

To summarise, over the next year:

- If yields do not change, investors win.

- If yields go down, investors win.

- If yields go up, prices will fall, but investors are starting from around a 4.77% return rather than a 1% return. Therefore, they could still earn a net positive return over the next 12 months.

Conclusion

We understand that it has been a very difficult 12 months for bond holders, as markets have adjusted from the possibility of negative interest rates to watching the Reserve Bank move to fight inflation.

Markets have moved quickly, as they should, to reflect this change. The way markets do that is through prices. So, while the returns over the past six months have been painful, they do make economic sense.

From here, the question is about the long-term place of bonds in investor’s portfolio. We strongly believe they still have a place. They remain a good diversifier, they are issued by investment grade borrowers, interest rate increases are factored in, and yields are much higher than they were 18 months ago.

If you have any concerns, please let us know. As always, we want you to be comfortable with your long-term investment strategy.

https://www.rbnz.govt.nz/hub/publications/monetary-policy-statement/monetary-policy-statement-may-2022

https://au.dimensional.com/funds/global-bond-sustainability-nzd-class

In the global sustainability bond fund