As this is being written, Russian forces have surrounded the capital of Kyiv. Ukrainian resistance fighters and defence forces are trying to hold out. But events are unfolding quickly and by the time you read this, the country may have fallen to the invading forces.

In the midst of such turmoil, markets have operated exactly as they should. Global uncertainty has increased. As a result, buyers require a higher expected return from purchasing shares. They achieve those higher expected returns by purchasing at lower prices. Sellers, meanwhile, are happy to accept a lower price and a resulting lower realised return in order to reduce their uncertainty.

Regardless of what motivates a trade, markets have been efficiently matching buyers and sellers forever. It’s why previous geopolitical crises ranging from the Korean War, the Cuban Missile Crisis, the Iranian Hostage Crisis, the Six Day and Yom Kippur wars, the Vietnam War, Russia invading Afghanistan, the collapse of the Soviet Union, the Iraqi invasion of Kuwait and the US invasion of Iraq (to name but a few), all spooked market participants, but didn’t impair the market’s ability to function properly.

While we do not know if markets will go lower from here, history has shown that over the long run, selling after the market falls is an overwhelmingly poor strategy, and one we encourage our clients to avoid.

However, there is a broader lesson in this conflict regarding diversification and the use of Emerging Markets.

Russia, in portfolio parlance, is called an Emerging Market. MSCI Russia Index (gross div.) returns back to January 1995 until the end of January 2022, is about 10.61% compounded. By any standards, that would be considered a very attractive long-run return.

However, with the aggressive stance Russian has taken against the Ukraine, the world has responded with wide-ranging financial and trade sanctions and the value of the Russian share market has fallen by more than 50% from its most recent high.

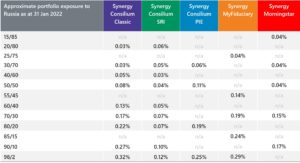

That’s a significant fall, but Synergy’s portfolios’ overall exposure to Russia is minimal, between 0.02% and 0.32% , as detailed in the table below:

Which leads to the question, why do we have any exposure to the Russian share market and if we have exposure, why is it so low?

The full answer requires a history lesson.

The term “Emerging Markets” was invented as a euphemism, a way of making something sound more attractive. It was invented in early 1980’s by Antoine Van Agtmael, Deputy Director of the Capital Markets department of the International Finance Corporation (part of the World Bank). Van Agtmael was trying to find a way to motivate investors to move capital into more obscure global markets. This was based on the premise that new investment would provide the conditions for capitalism to thrive, for economies to thrive and ultimately (when those two things come together), for freedom to thrive as well.

The term “Emerging Markets” wasn’t Van Agtmael’s first idea for a name. His first pitch was something along the lines of “Third-World Equity Fund”. Not surprisingly, that didn’t seem to attract investors. Upon reflection, he replaced the idea of “Third-World” with “Emerging” which he thought brought the idea of “progress, uplift and dynamism”, according to an article written in the Economist Magazine(1).

Although, in the 1980’s Van Agtmael could never have imagined that the USSR would devolve in 1989 and Russia would one day be open to foreign capital investment. Starting in late 1992, Russia’s capital markets started to take shape as a result of a large-scale voucher privatisation programme, where tens of thousands of former state enterprises were transformed into joint stock companies and privatised. Eventually, 300 or so firms would become public companies with shares traded in the market.

In a paper by Professor Boris Rubtsov(2) written in 2012, he stated, “Since its birth in 1992, the Russian securities market has become one of five leading emerging markets. 20 years is enough to evaluate the results of its development. At its peak in 2008, the capitalisation of Russian companies was US$ 1.5 trillion. In 2006– 2007, the indicator “capitalisation/GDP” had reached the average level of mature markets, exceeding many of them.”

However, the ride wasn’t always smooth. In 1998, the Russian government declared a moratorium on paying its debt. The fall in share prices was dramatic. According to Prof Rubtov, by the time the market bottomed out it was only worth 1/15th of its pre-crisis level. That’s right, one fifteenth! However, from 1999 the market started to recover. Prices increased over 60% in 2001 and 2002. After a downturn in 2004, the market was up 83% in 2005. In 2006 and 2007 the Russian market returned more than 70% in each year.

Then came the Global Financial Crisis (GFC) where the Russian share market bottomed out at 1/5th of its pre-GFC price. That’s better than 1/15th but still dire.

Are you getting a sense of the volatility of this market?

In some ways, that was the genius of Van Agtmael. He realised that any Emerging Market could experiment in capitalism. But foreign capital was necessary in order to build out these economies, improve wages for employees and find uses for untapped resources and talent. However, due to underlying political instability, immature market regulations, and the boom/bust nature of commodity focused economies that dominate many Emerging Markets, investing in any country would be very risky. Perhaps dangerous would be a more accurate term.

Yet avoiding these markets was not the answer. We’re all better off if these countries experience economic prosperity fuelled by foreign investment. The answer instead was to invest in all of them. By investing in all of them, investors could benefit from the opportunities these countries present, but do so without the dramatic ups and downs. Does it work? Yes, it works brilliantly.

If we look at the last 20 years from 01 January 2002 to 31 January 2022, we can see the annualised return and volatility of investing in either only Russia, against an index of Emerging Markets constructed by fund manager Dimensional Fund Advisors (DFA).

What this table shows is that over the last 20 years, you received about the same overall return from owning all Emerging Markets as you did if you owned only one (in this case Russia). However, you did so at less than half of the volatility. That’s a win for the investor.

But perhaps, in a more subtle way, there’s another win. You see, in the current climate it appears the West wants no part of a direct war with Russia. Instead, they are looking to inflict Russia with economic sanctions designed to increase the ‘price’ of its expansionist plans. This is a policy tool that was never open to Presidents Kennedy, Carter or Reagan, or Prime Minister Thatcher, because the USSR was already outside of the western financial system. The reason it may be effective this time is because Russia had previously opened its markets and were participating on the global stage.

It may be that these penalties are not effective, but we hope they are for the sake of the free people in the Ukraine. Ultimately, not participating in the global free economic system would be a huge cost to the wellbeing of Russian citizens. Unfortunately, its citizens don’t appear to be the Russian government’s highest priority.

It could be that in the coming months Russia falls out of the definition of what makes a country an Emerging Market. Several index providers, including MSCI, have suggested there is a strong potential Russia will be removed from their indices(3). Geopolitical change caused Russia to become eligible initially and geopolitical events could render it ineligible in the future. In either case, it’s going to be nearly unnoticeable to portfolios like ours where it represents such a small component, although a protracted war would continue to impact global share markets.

Whatever lesson you learn from this crisis, let it not be that investing in Emerging Markets is a bad idea. It represents a significant part of what has lifted so much of the world out of poverty in the last 30 years, and it has been of huge benefit to the investors that have received a solidly positive return on their investment, assuming it was sufficiently diversified.

And hopefully, by tying more countries into a free and prosperous system of trade it has done much to deter the type of 20th century expansionist policy that led to the current crises in the Ukraine.