Key market movements for the quarter

With the prospect of US interest rate hikes and simmering tensions at the Russia/Ukraine border, there were few places for investors to hide in January, as bond yields spiked and share markets waned. Growth-tilted sectors such as information technology and consumer discretionary bore the brunt of the pain, while the energy sector generally performed strongly.

Following Russia’s invasion of Ukraine in late February, investors became increasingly concerned. Markets tumbled as investors reassessed the potential economic impact of sanctions on Russia and on further supply chain upheavals.

With this adding further fuel to a developing global inflation problem, bond yields rose markedly over the quarter as central banks quickly signalled their intention to not let inflation expectations get out of control.

Unfortunately, with equity markets generally falling and bond yields rising (meaning falling bond prices), the first quarter of 2022 was a challenging environment.

International shares

Russia’s invasion drew widespread condemnation and elicited significant economic sanctions from democratic nations. This amplified existing concerns over inflation pressures, particularly in energy and food products.

In the USA, the flagship S&P 500 Index (total returns in USD) declined -4.6% in spite of US economic data otherwise remaining relatively stable and unemployment reducing to a low 3.6%.

Eurozone shares fell more sharply. The region has closer economic ties with both Ukraine and Russia, particularly when it comes to a reliance on Russian oil and gas. Worries over consumer spending led to declines for retailers, while the conflict also exacerbated supply chain disruptions by stifling the availability of a wide range of parts. This impacted the information technology sector in particular.

UK equities were more resilient as investors began to price in the additional inflationary shock of the Russian invasion. Large cap equities tracked by the FTSE 100 index even managed a small gain over the quarter, driven by the oil,

mining, healthcare and banking sectors.

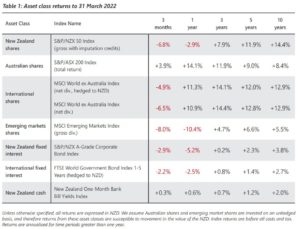

In New Zealand dollar terms, the MSCI World ex-Australia Index delivered a quarterly return of -4.9% on a hedged basis and -6.5% unhedged. This meant the rolling 12 month return for the New Zealand dollar hedged index is still a healthy +11.3% while the unhedged index has gained +10.9%.

Source: MSCI World ex-Australia Index (net div.)

Emerging markets shares

Emerging market equities were firmly down in the first quarter as geopolitical tensions took centre stage. US and its Western allies imposed a raft of sanctions on Russia and commodity prices moved significantly higher in response, raising concerns over the impact on inflation, the pace of policy tightening and the outlook for growth.

Trading in Russian companies (both inside Russia and on international exchanges) became fraught as investors sought to exit these exposures en-masse and their share prices crumbled. Russia was officially removed from the MSCI Emerging Markets Index on 9 March, at a price that was effectively zero.

Egypt, a major wheat importer, was one of the weakest markets in the MSCI Emerging Markets index, due in part to a 14% currency devaluation relative to the US dollar. China also lagged the index by a wide margin as daily new cases of Covid-19 spiked, and lockdowns were imposed in several major cities, including Shanghai. Regulatory concerns relating to US-listed Chinese shares also contributed to market volatility.

Conversely, the Latin American markets all generated strong gains, led by Brazil. Other net commodity exporters also posted sizeable gains, including Kuwait, Qatar, the UAE, Saudi Arabia and South Africa.

In unhedged New Zealand dollar terms, the MSCI Emerging Markets Index produced a quarterly return of -8.0%, contributing to a -10.4% return over the last 12 months.

Source: MSCI Emerging Markets Index (gross div.)

New Zealand shares

New Zealand was again one of the poorer performing global developed share markets over the quarter with the S&P/NZX 50 Index returning -6.8%. There was a wide divergence in sectoral returns over the quarter, with utilities and financial services firms generally outperforming, while healthcare and technology companies dominated the list of poorer performers.

New Zealand-based travel and expense management provider Serko Ltd declined -33.4% for the quarter as business travel volumes reduced during the important December and January period. This disruption, caused by the Omicron variant, impacted Serko’s revenue expectations for the year. Healthcare companies Ryman Healthcare, Fisher & Paykel Healthcare and Pacific Edge Ltd all fell between -23.4% and -27.8%. With the generally lower respiratory intervention requirements of the Omicron variant, as well as a relatively mild flu season in the Northern Hemisphere, some of the tailwinds that had propelled Fisher & Paykel’s strong share price performance throughout 2020 and into 2021, dissipated in the first quarter of 2022.

Although the list of companies delivering positive returns were in the minority, utilities firms with greater pricing power performed relatively well. Contact Energy, Vector, Genesis Energy, Spark, Chorus and Meridian Energy all returned between +2.4% and +5.3%, to help prop up the local market index.

Source: S&P/NZX 50 Index (gross with imputation credits)

Australian shares

The Australian share market (ASX 200 Total Return Index) bucked the trend by eking out a +2.2% return for the quarter in local currency terms. Returns to unhedged New Zealand investors were higher at +3.9% due to an appreciation in

the value of the Australian dollar over the quarter.

Once again, the dispersion in sectoral returns was a feature of the market, with the energy, materials, utilities and financials sectors all performing positively, while consumer discretionary, healthcare and information technology companies were the notable laggards.

Also notable was the generally strong performance of the large capitalisation firms, with top 20 companies Woodside Petroleum (+52.5%), BHP Group (+29.7%), Rio Tinto (+25.6%) and Santos (+24.5%) all benefiting strongly from increases in energy and/or key commodities prices.

At the other end of the spectrum, Hutchison Telecommunications fell -32.5% and Reece Group, a leading distributor of plumbing products to commercial and residential customers in Australia, New Zealand and the United States, experienced a decline of -29.2% in spite of posting a solid half year announcement.

Source: S&P/ASX 200 Index (total return)

International fixed interest

The narrative that inflation was transitory began to change at the beginning of the year and central banks increasingly signalled their inflation concerns, which drove bond yields higher.

While acknowledging the uncertainties related to the geopolitical situation and its economic implications, central banks have so far suggested that unless the growth outlook were to markedly deteriorate, they view inflation as the more pressing problem.

Inflation throughout Europe was revised up to 5.9% in February and inflation in the UK accelerated to 6.2%. In the US, inflation reached a 40 year high of 7.9% and is expected to remain elevated over the coming quarters.

With this backdrop, the European Central Bank confirmed that the tapering of the pandemic emergency purchase programme will now conclude in June. President Christine Lagarde also left the door open to a first interest rate hike later this year.

The US Federal Reserve, as expected, raised the Federal Funds rate by 0.25%, making it clear that further increases will be appropriate. Committee members now expect seven hikes this year, and four next year, implying interest rates could end this cycle higher than the committee’s perceived neutral rate of 2.4%.

After an initial rate hike in December, the Bank of England raised its policy rate by 0.25% twice in the first quarter, reaching 0.75%. At their March meeting, the Bank described geopolitical risks as having accentuated its prior expectations for weak growth and high inflation this year, before noting that their monetary policy “will act to ensure that longer-term inflation expectations remain well anchored”.

With investors now expecting rate hikes at a swifter pace, global bond yields rose notably through the quarter. The US 10-year Treasury yield increased from 1.51% to 2.35%, while the UK 10-year yield climbed from 0.97% to 1.61%.

While rising yields are a headwind for short term sovereign bond returns, corporate bonds generally performed even worse, as credit spreads widened due to a worsening economic outlook.

The FTSE World Government Bond Index 1-5 Years (hedged to NZD) returned -2.2% for the quarter, while the broader Bloomberg Global Aggregate Bond Index (hedged to NZD) returned -4.8%.

Source: FTSE World Government Bond Index 1-5 Years (hedged to NZD)

New Zealand fixed interest

The Reserve Bank of New Zealand (RBNZ) elected to increase the Official Cash Rate (OCR) by a further 0.25% on 23 February, moving this benchmark rate from 0.75% back to its pre-Covid level of 1.00%.

In making this adjustment, the Monetary Policy Committee noted that the most significant risk to be avoided at present was for longer term inflation expectations rising above the bank’s target and becoming embedded in future price setting.

The Committee stated that while higher interest rates are necessary, households and firms may have become more sensitive to interest rate changes as their debt levels have risen. Accordingly, the behavioural responses of household and businesses in the face of higher interest rates, will be important considerations in determining the pace of future interest rate tightening. For the time being, the RBNZ are currently projecting the OCR hitting 3.4% by late 2024, however they acknowledge the pathway towards that level could well include individual rate hikes of larger than 0.25%, if deemed necessary.

Given this outlook, the New Zealand 10 year government bond yield climbed from 2.33% at the end of 2021 to 3.25% at the end of March, an increase of 0.92% over the quarter. The New Zealand 2 year government bond yield followed a similar pattern, beginning the year at 1.98% and ending the March quarter at 2.92%, a yield increase of 0.94%.

Similar to the effects seen overseas, these rising bond yields generally resulted in negative short term returns for bonds of all durations.

The S&P/NZX A-Grade Corporate Bond Index fell -2.9% for the quarter, while the longer duration but higher quality S&P/NZX NZ Government Bond Index fell -4.3%.

Source: S&P/NZX A-Grade Corporate Bond Index